EPEX SPOT operates organized short-term electricity markets for Central Western Europe, Great Britain, the Nordics and Poland. We offer a large range of products, to trade across the entire value chain of electricity.

Discover the largest exchange for physical power trading in Europe

Day-Ahead trading

EPEX SPOT offers Day-Ahead trading in thirteen European countries. Day-Ahead markets are operated through a blind auction which takes place once a day, every day of the year. The traded electricity is delivered on the next day. Apart from Switzerland and Great Britain, all markets are part of the Multi-Regional Coupling (MRC) which stretches across 19 markets from Portugal to Finland and from The Netherlands to Italy. All auction markets of EPEX SPOT run on the MATS trading system, a robust and reliable trading platform.

Our Day-Ahead offer at a glance

- Robust and reliable trading guaranteed on our EPEX Trading System

- Optimized EU Market Coupling with our implicit auctions - ensuring the best use of interconnection capacity and most efficient use of your assets

- Highest liquidity and diversity of portfolios with over 500 TWh traded per year representing a third of the consumption of the thirteen countries covered

- Widest product offering from single hours and blocks to smart and big blocks: exclusive, linked, loop & curtailable

Easy access to your order submissions & results through our API

Hourly Day-Ahead auctions

Tradable contracts: 24 hourly contracts corresponding to the 24 delivery hours of the following day – traded either in single hours or in blocks of combined hours

Closure of orderbook: daily at 12:00 (CET) (9:20 GMT for Great Britain, 11:00 CET for Switzerland) in D-1

Publication of results: from 12:57 (CET) onwards (9:30 GMT for Great Britain, 11:10 CET for Switzerland)

See our Market Results published daily.

Half-hour Day-Ahead auction in GB

Following the Day-Ahead auction, the Half-hour Day-Ahead auction in Great Britain gives members the opportunity to balance their physical portfolios and to further optimize their generation portfolio.

Tradable contracts: 30-minute contracts, with delivery on the following day

Closure of orderbook: daily at 15:30 (GMT) in D-1

Publication of results: from 15:45 (GMT) onwards

Blocks

Classic block orders encompass several hours at the same price with flexible volume profiles and are executed at the same ratio on all its hours. Smart & big blocks are unique to our auctions because of their complexity and unparalleled size – allowing you to sophisticate your optimization strategy.

Big blocks: larger than classic blocks with the maximum size going up to 1500 MW and allows to cover large production capacities

Loop blocks: families of two blocks which are executed or rejected together. They allow to bundle buy and sell blocks to reflect storage activities - only offered at EPEX

Curtailable blocks: set of blocks which can be either entirely executed or entirely rejected (All-or-None); or executed above a minimum acceptance ratio defined by traders

Linked blocks: set of blocks with a linked execution constraint, meaning the execution of one block depends on the execution of its father block. They allow to represent the variation of electricity generation with regards to the market price

Exclusive blocks: group of blocks within which a maximum of one block can be executed, so your electricity is traded at the most profitable moment

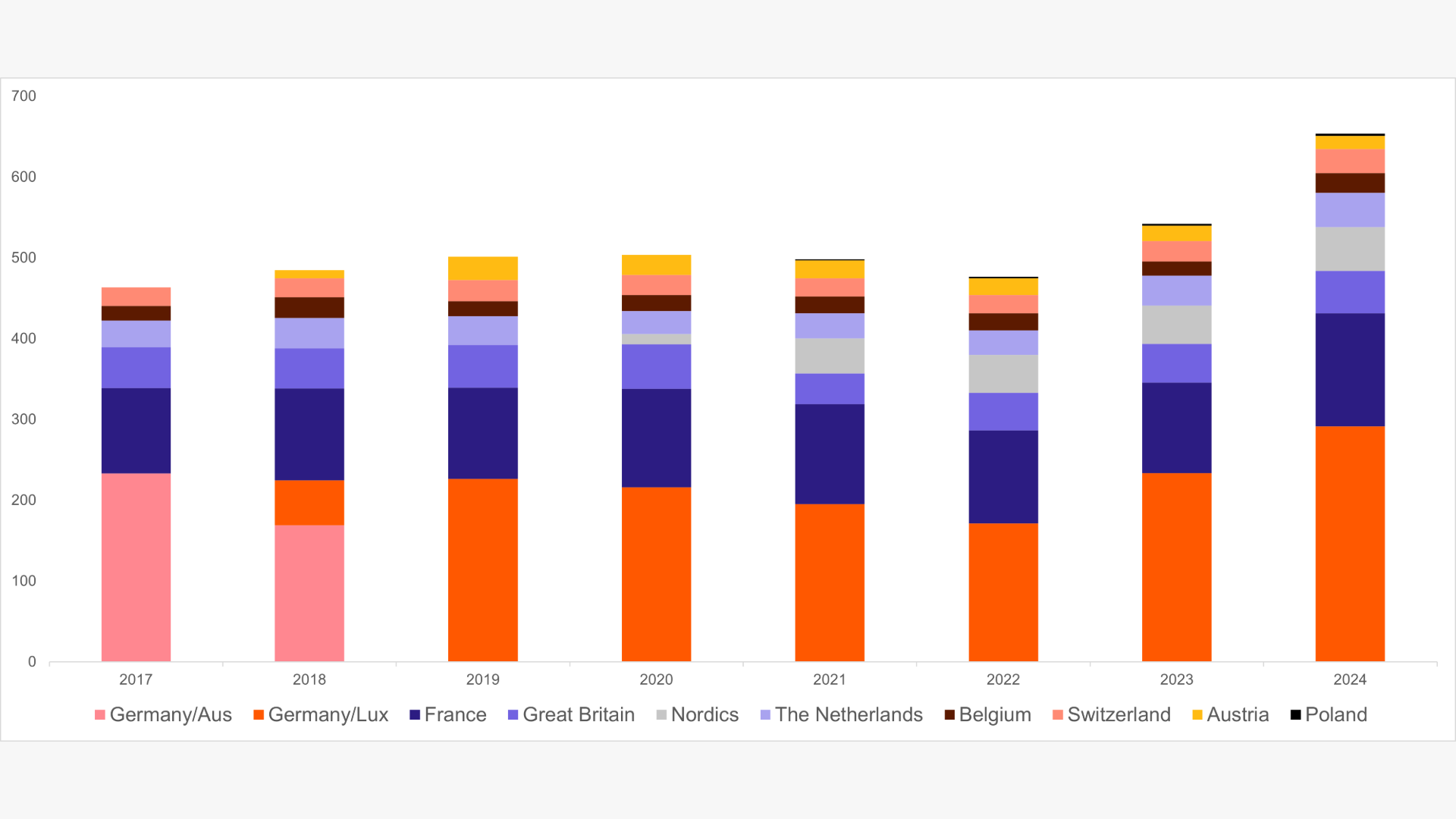

Traded volume on the EPEX Day-Ahead

-

-

You can download :

-

Intraday trading

The Intraday market segment at EPEX SPOT offers both continuous and auction trading in thirteen European countries. All continuous Intraday markets of EPEX SPOT run on the M7 trading system, with the highest standards in terms of performance and reliability. These markets are by far the most liquid in Europe.

Our Intraday offer at a glance:

- Most liquid orderbook in Europe from opening to delivery time, running 24/7 to support the most advanced trading strategies

- Highest performing Intraday continuous trading system (M7) with more than 10,000,000 orders submitted every day

- Multiple contract types offering finer granularity and increased flexibility

- Versatile, performant and standardized API services for order submission and results retrieval

Wide range of Intraday auctions allowing you to further optimise your Intraday portfolio while benefitting from a robust reference price

Intraday continuous

All our Intraday Continuous markets run on the M7 trading system powered by Deutsche Börse AG, used across Europe and recognized as the industry-standard in terms of performance and reliability, supporting the most advanced trading strategies.

Tradable contracts: 60, 30 and 15min contracts

Trading opening:

- 00:00 (GMT) D-1 in GB

- 14:00 (CET) D-1 in the Nordics, Belgium, The Netherlands and Poland

- 15:00 (CET) D-1 in Austria, France, Germany and Switzerland

Closure of orderbook: up until 0 minute before delivery start of the contract

Trade execution: as soon as two entered orders match on our platform, the trade is executed

Intraday auctions

We offer a full suite of Intraday auctions in CWE, the Nordics, Poland, Great Britain and Switzerland.

EPEX SPOT has been a front-runner by launching in 2014 the very first Intraday auction in Europe for 15 minutes contracts, in Germany. Since then, we have expanded our Intraday auctions in 13 countries – with a total traded volume reaching more than 16 TWh in 2023. In 2024, all EPEX European Intraday auctions were coupled in the SIDC pan-European framework.

SIDC Intraday auctions in Austria, Belgium, Denmark, Finland, France, Germany, The Netherlands, Norway, Poland, Sweden

• IDA 1: D-1 15:00 for all delivery periods of delivery day D

• IDA 2: D-1 22:00 for all delivery periods of delivery day D

• IDA 3: D 10:00 for delivery periods comprised between 12:00 and 24:00 of delivery day D

Intraday auctions in Switzerland

Switzerland 60 min – daily at 17:40 (CET)

Switzerland 60 min – daily at 10:30(CET)

Intraday auctions in Great Britain coupled with Ireland

Great Britain 30 min – daily at 17:30 (GMT)

Great Britain 30 min – daily at 8:00 (GMT)

The detailed product specifications are available in the Downloads section on the website in your Member Area.

SIDC – The pan-European Single Intraday Coupling

EPEX SPOT is part of SIDC, an initiative enabling cross-border trading in one integrated European Intraday market. This solution links the local trading systems operated by Power Exchanges with the available cross-zonal transmission capacity provided by Transmission System Operators. You can find more information on SIDC here.

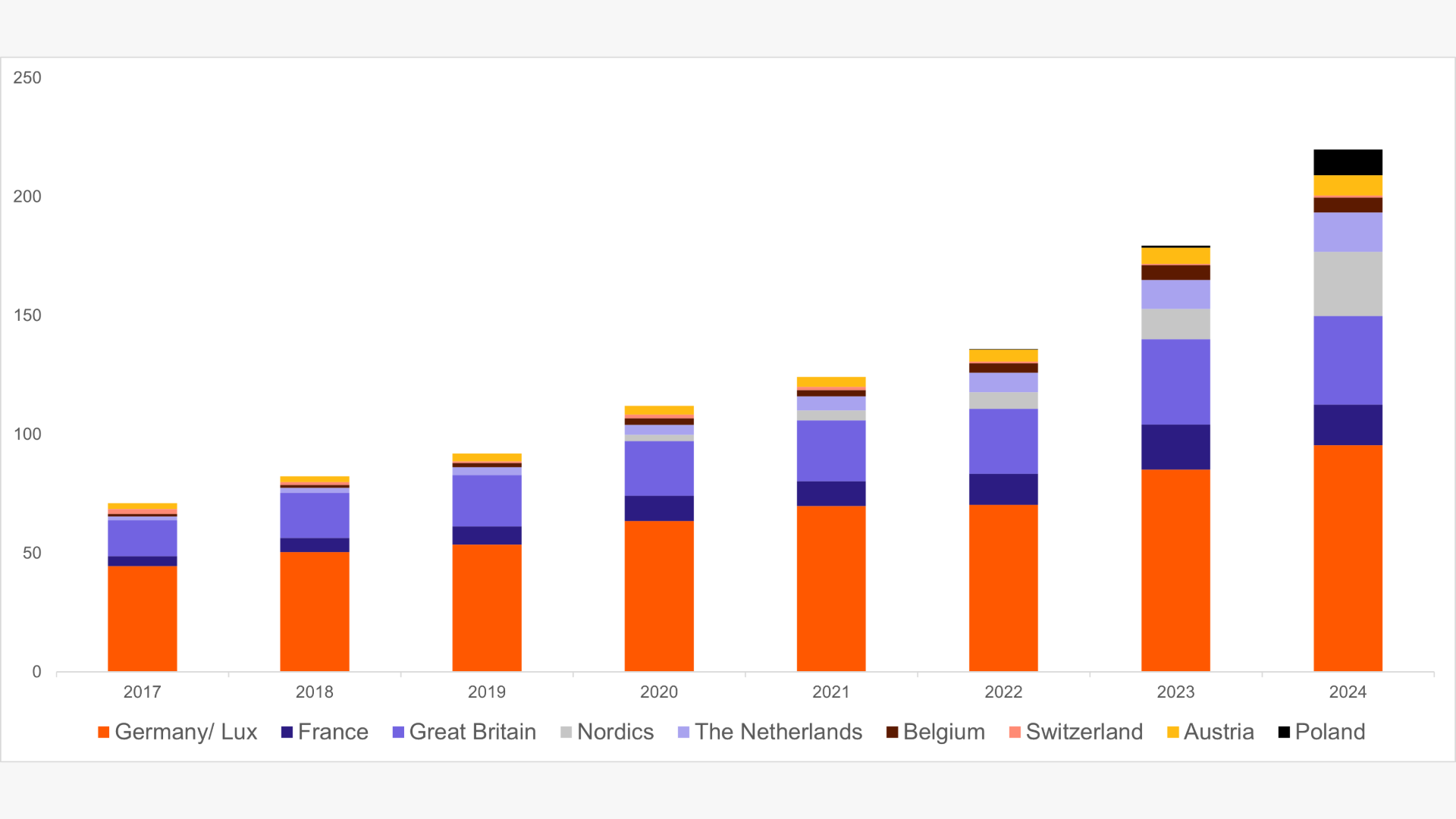

Traded volume on the EPEX Intraday

After-Market trading

The After-Market provides additional flexibility to market participants by allowing trading after delivery. Contracts are available for trading as of the physical delivery of the contracts until the next trading day through the unique EPEX SPOT M7 continuous trading system. It enables the adjustment of your physical positions in the ex-post timeframe, thus reducing costs related to imbalance settlement. In the Netherlands, After-Market allows market participant to further optimize in case of dual-pricing for imbalance settlement.

Belgium

- Trading start: Delivery start of the Intraday continuous contract

- Trading end: 12:30 day after delivery (D+1)

The Netherlands

- Trading start: Delivery start of the Intraday continuous contract

- Trading end: 8:30 day after delivery (D+1)

Guarantees of Origin Spot Market

In electricity trading, the source of an electron cannot be distinguished once it is injected into the network. To enable the tracking of the origin of renewable electricity, the European legislation created a green label called Guarantees of Origin (GOs).

Find out more about our offer on the dedicated Guarantees of Origin (GOs) page.

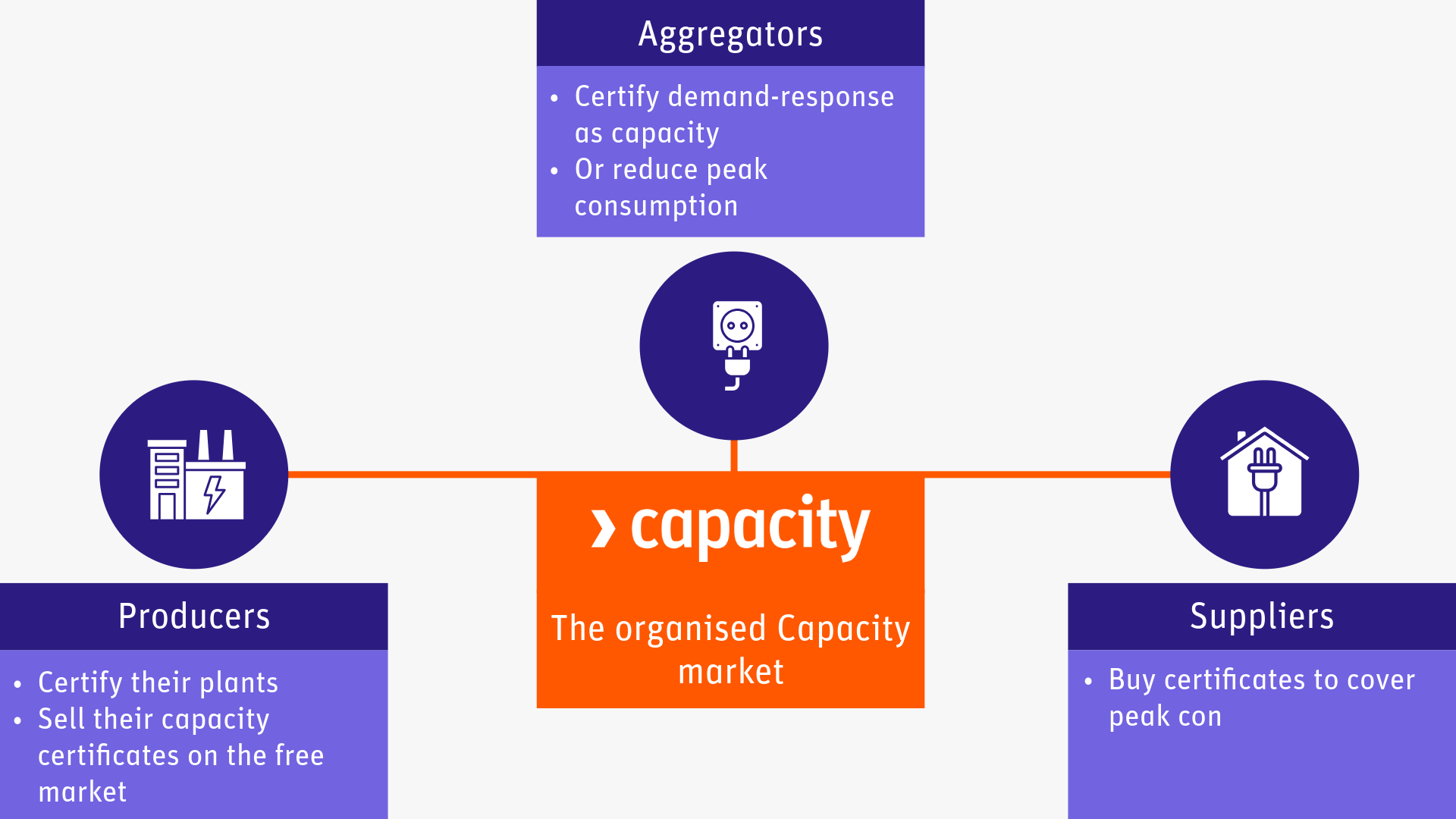

French Capacity Market

An organized market for French capacity guarantees.

The French law foresees a capacity obligation scheme. It specifies that electricity producers and demand-response operators receive capacity certificates by the French Transmission System Operator RTE. Suppliers have to contribute to security of supply by holding sufficient capacity certificates to cover the peak consumption of their costumers for each underlying year.

On the capacity market operated by EPEX SPOT, the demand for capacity guarantees meets the offer, determining a price for capacity which reflects security of supply needs to cover peak consumption in France.

The results of the past auctions are listed here.

The current Auction Calendar is available here.

If you wish to trade on the French capacity market, please get in touch with your Key Account manager or send an e-mail to sales@epexspot.com. You can find more information on the capacity market in our dedicated brochure and in the download section.

Detailed product specifications are available in the member section.

Future-to-Spot Service

The Future-to-Spot Service (FTS Service) is a service provided by EEX and EPEX SPOT where you can fulfil your Futures positions on the Day-Ahead auction to complement your volumes traded directly through the EPEX SPOT Trading System (MATS).

How does the FTS Service work?

Trading participants active on both EEX and EPEX SPOT markets are able to enter bids in the corresponding Day-Ahead auction according to the participants' respective position in an EEX power futures contract. The creation and forwarding of the required bidding sheets can be done automatically by EEX or manually via the Trading Participant. Download our User Guide to learn more about the process.

The FTS Service is offered in 12 countries across Europe: Austria, Belgium, Denmark, Finland, France, Germany, Great Britain, The Netherlands, Norway, Poland, Sweden and Switzerland.

Localflex trading

An innovation powered by EPEX SPOT

Through our solutions flexibility service providers gain news opportunities to value their flexible assets and system operators obtain new tools to manage congestions and optimize grid planning.

Starting 2017, EPEX SPOT collaborated on various initiatives to develop marketplaces where flexibility demand and supply could meet on neutral and transparent flexibility markets. With Enera and Enflate, its first pilot projects for flexibility markets, EPEX SPOT has developed its expertise to efficiently manage local congestions and peak load in the power grid for Europe.

Since 2023, Localflex Continuous NL market, centralizes flexibility offers where and when needed in the Netherlands, using M7 continuous platform, connected to GOPACS.

Moreover, EPEX SPOT’s Localflex is completed by the LEM platform, an end-to-end solution for auction market.

Localflex fosters the integration of renewable energy sources and increases the engagement of consumers and producers in congested grid areas such as Great Britain, where EPEX SPOT has established a partnership with UK Power Networks, the leading electricity distributor in London, the South East and East of England.

Organisation of EPEX Localflex

You are a Flexibility Service Provider and you want to learn more about our Localflex trading offers? Download our brochure or send us an email sales@epexspot.com