Leipzig, Paris 3 December 2009. In the framework of their cooperation European Energy Exchange AG (EEX) and the French Powernext SA have integrated their Power Spot and Derivatives Markets.

In November 2009, a total volume of 113.4 TWh was traded on the joint subsidiaries EPEX Spot SE and EEX Power Derivatives.

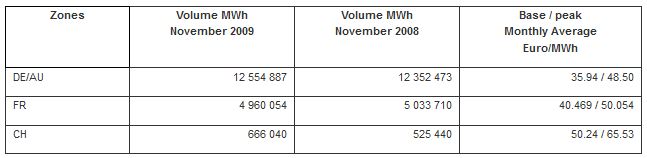

Power trading in the day-ahead auction on EPEX Spot accounted for in total 18,180,982 MWh of this and can be broken down as follows:

In November, a total of 750 832 MWh was traded on the intraday market:

• Germany 654 808 MWh, same month of the previous year 223 954 MWh

• France 96 024 MWh, same month of the previous year 63 375 MWh

The volume in power derivatives trading on EEX Power Derivatives amounted to 94.4 TWh in November (same month of the previous year: 92.9 TWh). This comprises 2.3 TWh from trading in French Power Futures. The derivatives trading volume comprises 64.3 TWh from OTC clearing. On 30 November 2009, the open interest amounted to 535.5 TWh. On the Power Derivatives Market, the baseload for the year 2010 was quoted at EUR 43.81 per MWh (Germany) and at EUR 47.54 per MWh (France) on 30 November. The peakload price for the year 2010 amounted to EUR 59.48 per MWh (Germany) and to EUR 64.72 per MWh (France).

EEX Power Derivatives GmbH operates the German and the French Power Derivatives Market and, hence, occupies a central position in power trading in Continental Europe: The trading participants can trade both Phelix Futures and Options with financial settlement and power futures settled physically with delivery to Germany and France. EEX AG holds 80 percent of the shares in EEX Power Derivatives GmbH and the French Powernext SA holds the remaining 20 percent. EEX Power Derivatives GmbH, established on 1 January 2008, is based in Leipzig and also has a branch in Paris.

EPEX Spot SE is a Paris-based company under European law (Societas Europaea) with a branch in Leipzig. EEX and Powernext each hold 50 percent in the joint company, in which they have integrated their entire spot power trading activities. The product range of EPEX Spot SE encompasses spot power trading for France, Germany/Austria and Switzerland. Together these countries account for more than one third of the European power consumption.

Clearing and settlement of all EPEX Spot and EEX Power Derivatives transactions are provided by European Commodity Clearing AG (ECC), based in Leipzig, the clearing house of EEX and its partner exchanges.