Overview

Based on the Trading and Cooperation Agreement set out, GB’s electricity market is not part of the Internal Energy Market.

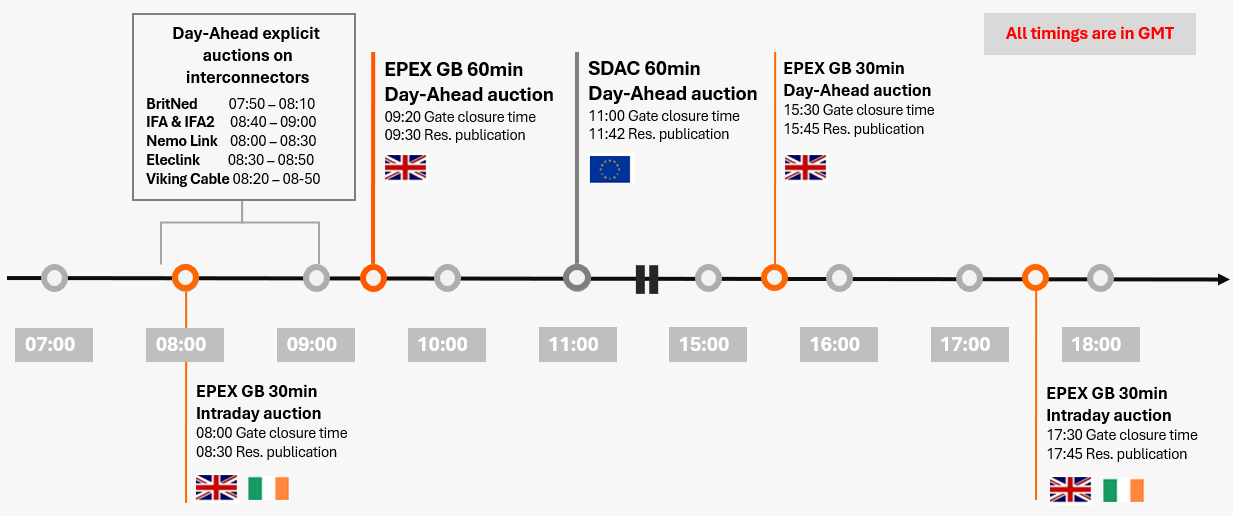

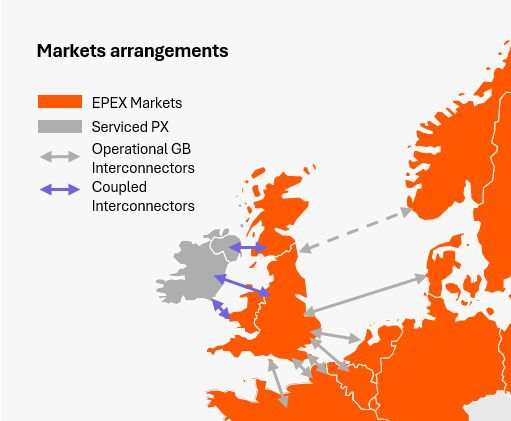

All EPEX SPOT GB Day-Ahead and Intraday markets continue to run. However, the GB Day-Ahead 60 min auction is no longer part of the European Single Day-ahead Coupling (SDAC). Since the end of the transition period, the interconnectors on the borders of GB-FR, GB-BE and GB-NL run explicit auctions for their capacity.

The applicable European regulatory framework facilitated GB’s power exchanges to compute a single GB Day-Ahead reference price through a joint implicit capacity allocation service. Now each power exchange runs and calculates their own Day-Ahead auction results independently of any cross-border capacity allocation process and of each other.

Market coupling continues to operate on our GB Intraday auctions coupled with Ireland where the cross-border capacity between the Island of Ireland and Great Britain remains implicitly allocated on the GB IDA1 (17:30 GMT) and GB IDA2 (8:00 GMT) auctions.