Membership profile of EPEX SPOT

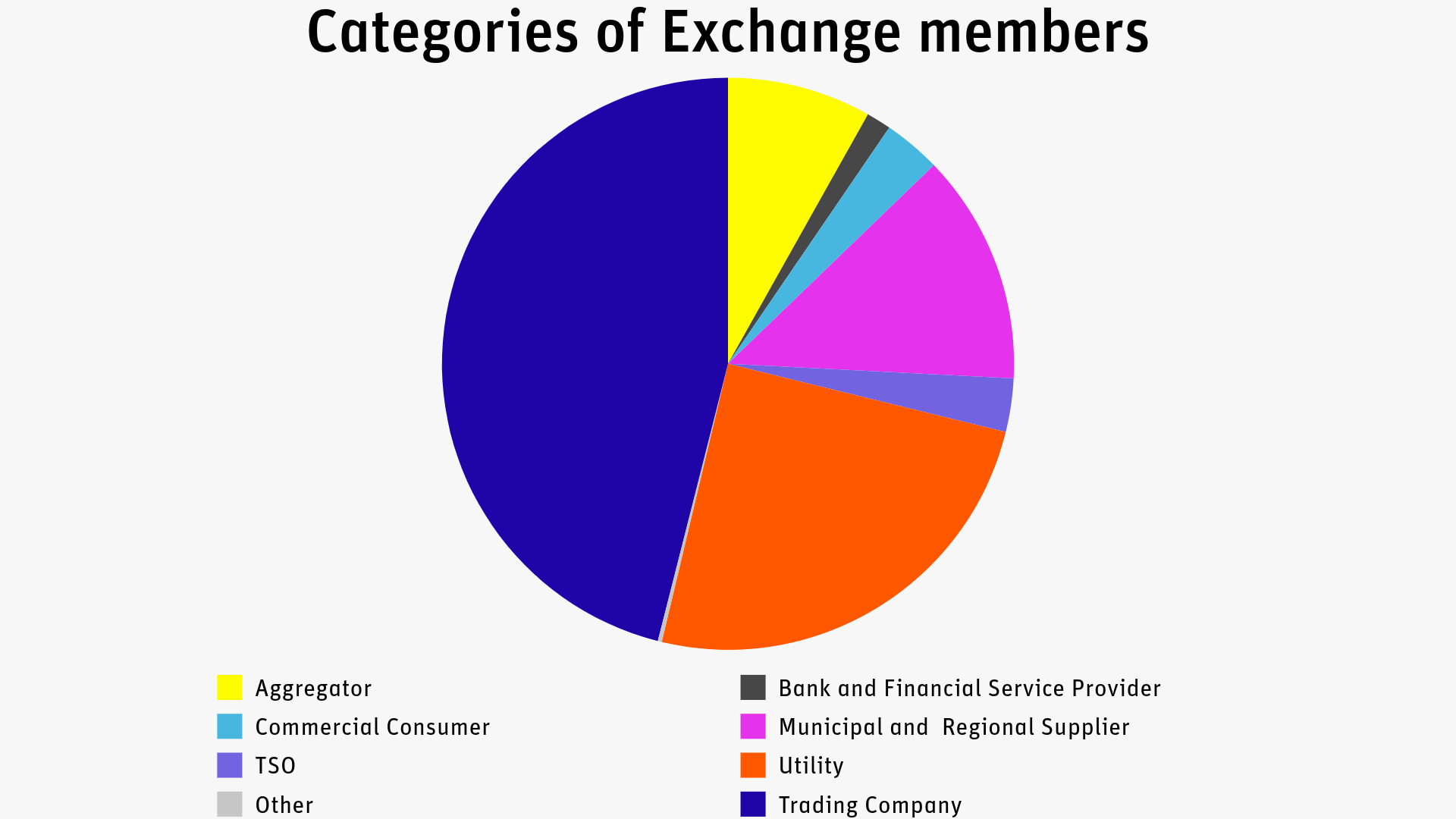

The membership profile of EPEX SPOT is highly diverse. Some companies also specialise in pooling small assets, from decentralised renewable producers, demand response aggregators, or other smaller suppliers, to pool knowledge and infrastructure. Third-party trading is allowed on EPEX SPOT markets, and some members also trade on behalf of smaller companies.

Aggregators operate power plant pools or virtual power plants. They act on behalf of a group of consumers, gathering liquidity, which they then bring to the wholesale market.

Banks and financial service providers have an essential role in providing additional liquidity in the wholesale power market. These companies do not necessarily own power assets but are active on the market.

Commercial Consumers are actors from energy-intensive industries, are also involved in the wholesale market to purchase power at the wholesale market price.

Municipal and regional suppliers specialise in supplying end consumers. They often provide a whole set of services to their consumers, such as power and gas supply, water and waste infrastructure, and so on.

Trading companies provide additional liquidity to the market and have advanced expertise in the management of electricity portfolios and power trading. These companies do not own power assets.

Transmission and Distribution System Operators intervene in the spot markets to compensate for their grid losses. In Germany, they are also in charge of marketing green electricity as a result of the feed-in tariff regulatory scheme.

Utilities buy and sell electricity to adjust imbalances between the production of their power plants and the supply to their customers.

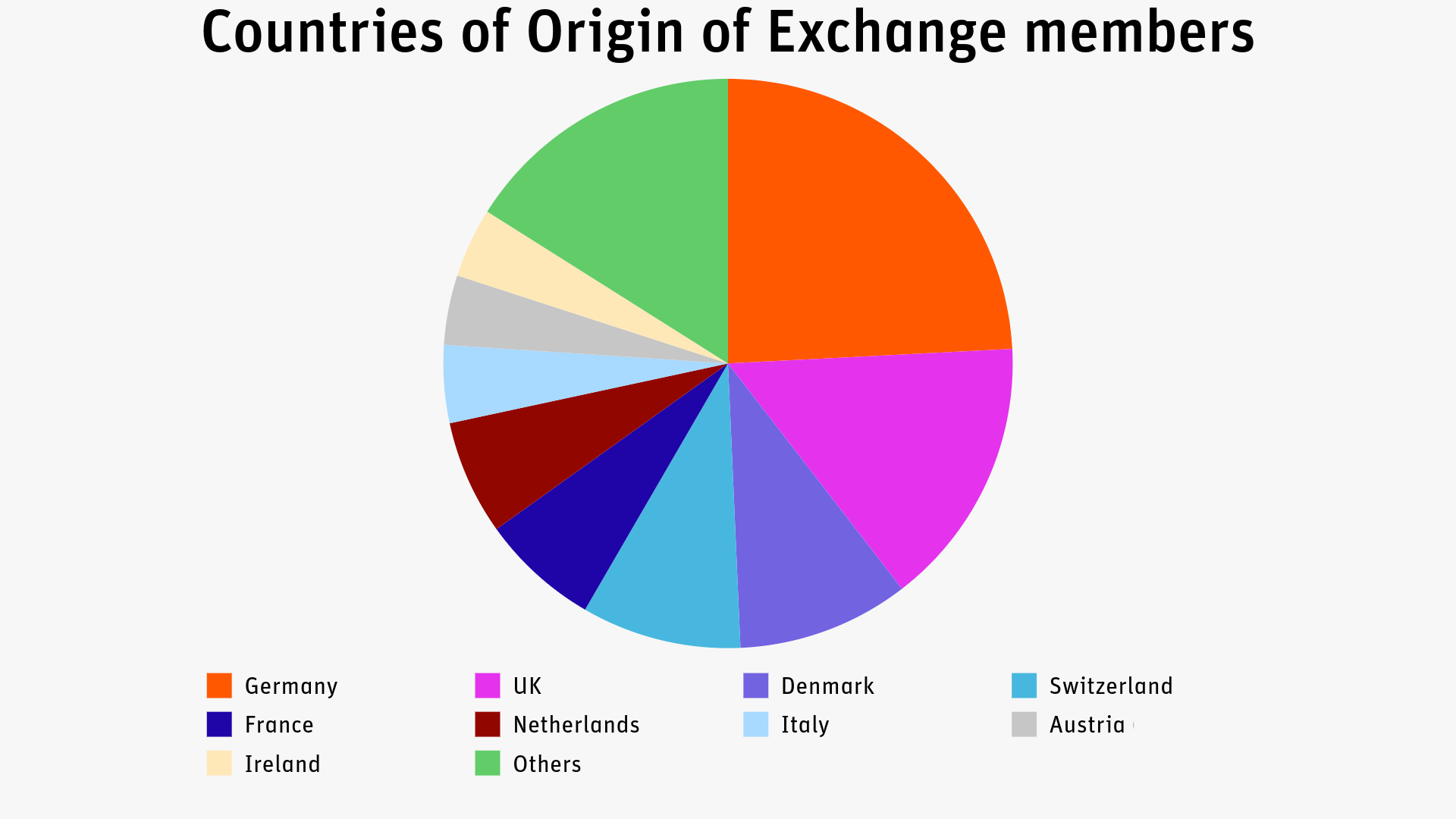

Countries of origin of the members

EPEX SPOT members are also geographically spread out, coming from more than 25 different countries. 24% of our members are from Germany, 15% are from the United Kingdom, and 10% are based in Denmark. Other well-represented countries include Switzerland, France, the Netherlands, Italy, Austria and Ireland.